Rocket Money

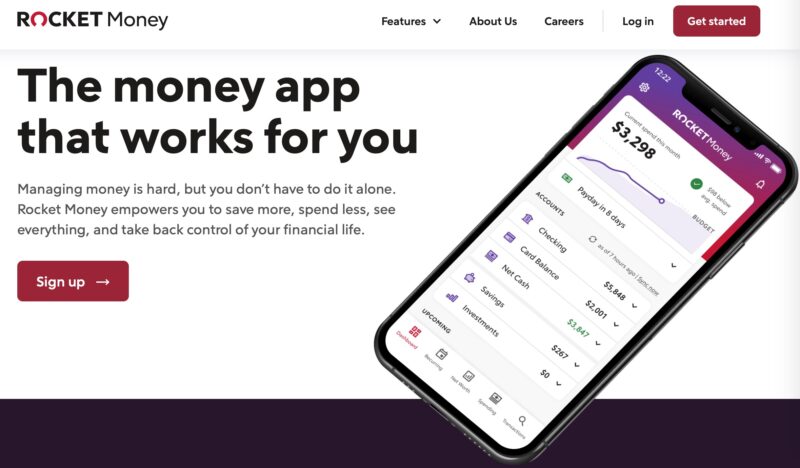

Product Name: Rocket Money

Product Description: Rocket Money is a budgeting app with several money management features, including subscription management.

Summary

Rocket Money is an app with several features to help you manage your money. Its subscription management features make it easy to see all your subscriptions in one place. The app also gives step-by-step instructions on how to cancel subscriptions, or if you have a paid plan, it will cancel them on your behalf.

Pros

- A free plan is available

- Subscription management

- Multiple money management features

- “Pay what’s fair” option on the Premium plan

Cons

- Best features require a paid subscription

- Credit score monitoring only updates monthly

Rocket Money is an app that can help you manage your finances, cancel unwanted subscriptions, and negotiate your current bills. In addition to subscription management, it allows you to monitor your credit and net worth.

The budgeting features sync with your accounts, allowing you to categorize your transactions against your budget easily.

There is a free plan and a “pay-what’s-fair” plan that costs between $6 and $12 per month.

At a Glance

- Subscription management and cancelation services

- Bill negotiation services

- Budgeting features

- Credit and net worth tracking

- Free and paid plan available

Who should use Rocket Money

Rocket Money’s best features are the subscription management and the bill negotiation service. If you struggle to overcome the friction of canceling unwanted subscriptions, Rocket Money is a must. It will pull all your subscriptions into one place. On the free plan, it gives step-by-step instructions on how to cancel and will cancel them for you on the paid plan.

The bill negotiation service is available on both plans; you’ll pay a percentage of your savings.

Alternatives to Rocket Money

| Primary service | Budgeting | Net worth tracking | Bill negotiation |

| Pricing | $14.99 monthly or $109 annually | Free | 50% of annual savings |

| Learn more | Learn more | Learn more |

Table of Contents

- At a Glance

- Who should use Rocket Money

- Alternatives to Rocket Money

- What Is Rocket Money?

- How Does Rocket Money Work?

- Rocket Money Features

- Account Syncing

- Manage Subscriptions

- Bill Cancellation

- Bill Negotiation

- Budgeting Features

- Smart Savings

- Net Worth Tracker

- Credit Score Monitoring

- Rocket Money Pricing

- Is Rocket Money Safe?

- Alternatives to Rocket Money

- FAQs

- Is Rocket Money Worth It?

Rocket Money is a budgeting app for Android and Apple devices.

There are both Free and Premium plans, each with various perks.

Some of the member perks include:

- Account tracking

- Subscription management

- Balance alerts

- Subscription cancellation assistant

- Bill negotiation

- Budgeting

- Credit score tracking

- Net worth tracking

You’ll get the most from Rocket Money if you use it to monitor your spending and the subscription management tools. Its free tools make it an ideal budgeting app, but the premium subscription remains affordable if you don’t need hands-on budgeting help.

How Does Rocket Money Work?

You can follow these steps to join Rocket Money:

- Download the Android or Apple mobile app

- Link your financial accounts

- Analyze spending habits

- Look for ways to save money

- Create budgeting and savings goals

- Monitor financial progress with regular updates.

Rocket Money Features

Account Syncing

Rocket Money links your banking, credit card, and investment accounts through Plaid. This third-party service has read-only access and doesn’t store your sensitive details for extra privacy.

Your account balances update daily the first time you log into your account. The app will send spending insights and alerts when direct deposits hit your account. Linking as many accounts as possible makes it easy to see how much you spend and earn accurately.

After linking your accounts, you can begin categorizing your transactions. Rocket Money auto-categorizes most transactions, so the ongoing maintenance requirements are minimal.

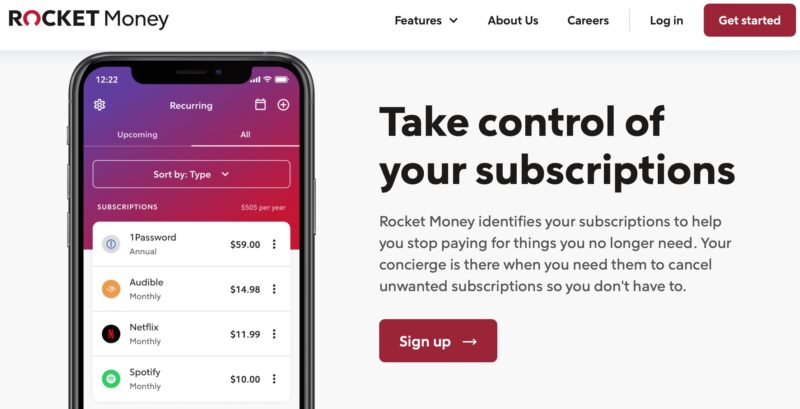

Manage Subscriptions

This feature is one of Rocket Money’s most useful features.

You may intuitively have a ballpark estimate about your fixed living expenses, such as utility bills, food, and childcare. What about your subscriptions? Especially subscriptions that bill annually. It’s very easy to forget about these bills until it’s too late, and you’ve accidentally paid for another year.

After linking your accounts, Rocket Money looks through your transaction history for recurring subscriptions and lists them in one place so you can easily see them.

This feature is a good exercise in determining which services you regularly use and the others you can live without.

Bill Cancellation

Premium subscribers can have the app cancel subscriptions on their behalf. Free users will receive step-by-step directions to stop service, which can save you time despite doing the hard work yourself.

This feature is helpful if you’re the type to keep putting off canceling because it takes too long or — if you’re like me — you aren’t exactly sure how to do it, so you just don’t.

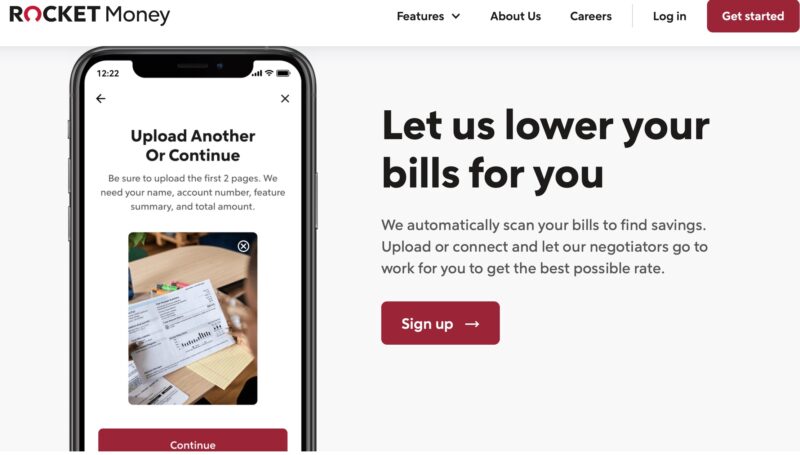

Bill Negotiation

All subscribers can see if Rocket Money will negotiate your existing bills for a lower rate. This is an excellent exercise to practice at least once a year for services you can’t live without to ensure you’re paying the best price.

Some of the best savings opportunities include:

- Cable or satellite TV

- Home Internet

- Postpaid phone plans (i.e., Verizon Wireless, AT&T, and T-Mobile)

- Satellite Radio

- Newspapers

Cable bills and contract cell phone plans have the most potential for discounts. The bill negotiator may see if they can switch you to a newer plan that has the same features as your existing plan but is cheaper. There may also be loyalty bonuses or limited-time promotions that can reduce your bill for the following year.

The service claims to have an 85% success rate in lowering your bills. You pay a one-time success fee and get to decide how much of the first year of savings to contribute as payment.

Rocket Money can also try to save money on these expenses:

- Car insurance

- Bank overdraft fees

- Bill payment late fees

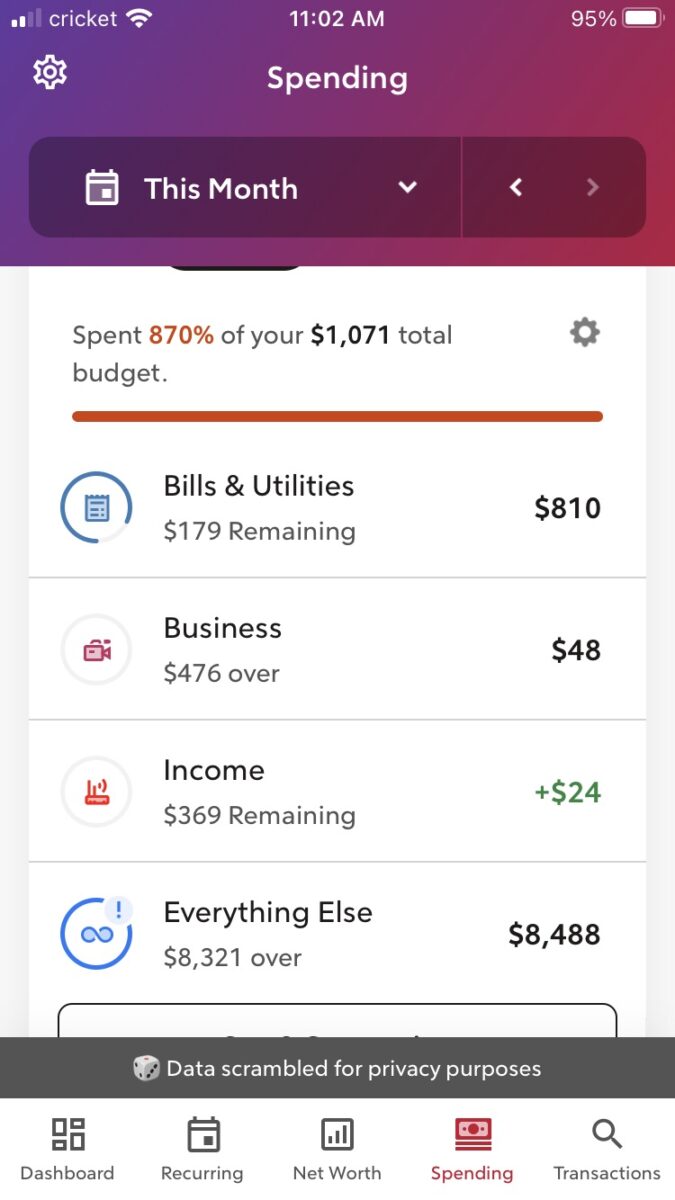

Budgeting Features

In addition to real-time spending alerts and direct deposit notifications, Rocket Money lets you create a simple spending plan. The budgeting tools are not as powerful as some free budgeting tools, but they can help you quickly see if you’re living within your means for the month.

This budgeting app generates a monthly report summarizing your spending and income patterns. It’s also possible to analyze these topics throughout the month:

- Bills paid

- Current spending

- The income left for savings.

- Money left for spending

- Monthly earnings so far

Most reports are available on a weekly, monthly, quarterly, or yearly period.

Premium members can create unlimited budgets and use account sharing so you can budget with another premium member.

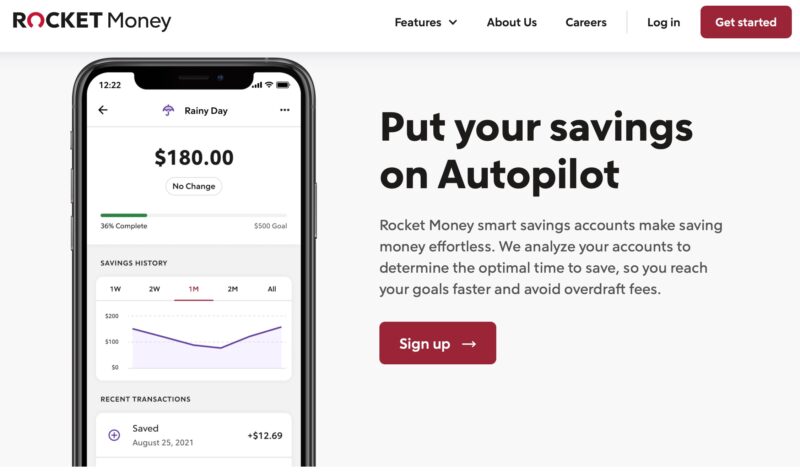

Smart Savings

Premium subscribers can use the Smart Savings feature to contribute to their savings goals automatically. You can decide how much to save and how frequently to withdraw from your linked checking account.

To prevent account overdrafts, the service skips withdrawals when you have insufficient funds in your account.

Your cash goes into an FDIC-insured account until you’re ready to spend it. Unfortunately, you may not earn interest on these deposits. Instead, consider a high-yield savings account to make money on your short-term savings.

Net Worth Tracker

Premium members can also track your net worth through your linked accounts. This feature may not be as essential as budgeting or tracking spending, but it’s another way to monitor your financial progress.

There are more powerful net worth tracking tools, but Rocket Money does an adequate job.

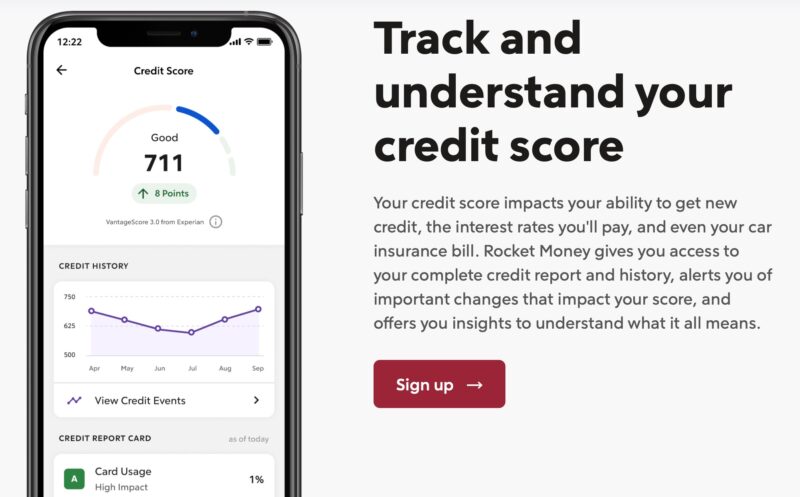

Credit Score Monitoring

Free users can view their Experian VantageScore 3.0 credit score for free. The app refreshes your score monthly. Although this isn’t the same score that most lenders use to make credit decisions (that would be the FICO Score from the Fair Isaac Corporation), it will give you a good estimate of your creditworthiness.

You can also see areas of improvement that can help you achieve a good credit score. However, free subscribers won’t be able to access their credit report.

Premium members can view their full Experian credit report. This report updates monthly, so be sure to access it regularly to avoid missing an update.

This is a nice feature, and it helps assess your complete financial picture. Keep in mind there are several ways to check your credit score for free with more constant updates. Other credit monitoring services may retrieve your score from more credit bureaus and possibly offer your FICO Score.

Rocket Money Pricing

Two different membership plan options are available: Lite and Premium. Pricing for Lite is free, and Premium is $3 – $12 but features a “Pay What’s Fair” option, which I’ll explain in more detail below.

A 7-day free trial is available on the Premium plan.

Free

The Lite plan is the standard option and is free for life.

Its benefits can get the job done and include the following:

- Account linking

- Balance alerts

- Subscription management

- Spend tracking

- Daily account syncing

The free plan is best if you want to monitor your spending and account balances but don’t need hands-on help canceling or negotiating a lower price for recurring bills.

The budgeting tools are limited to two categories, which can be sufficient to avoid overspending on your most significant monthly expenses.

Premium: $6-12 / month

The Premium plan offers a 7-day free trial, and then you choose to pay between $6 and $12 per month. This app follows a “Pay What’s Fair” strategy, so you can decide how much to spend.

According to Rocket Money, the average paid user pledges $6.99 monthly.

To help you decide if Rocket Money Premium is worth it, these are the available perks:

- Unlimited budgets

- Credit score and full credit report (vs. credit score only)

- Automated subscription cancellations

- Bill cancellation concierge

- Net worth tracking

- Real-time account syncing (vs. daily syncing)

- Shared accounts

- Premium chat

- Export data

You might want to upgrade to the premium plan if you want unlimited budgets, shared accounts, or automated subscription management tools.

Is Rocket Money Safe?

Yes, Rocket Money is a safe way to monitor your banking account transactions, look for ways to reduce spending, and track your credit score.

Most personal finance software apps use the same third-party service (Plaid) to connect to your accounts. This software doesn’t store personal information on its servers and uses bank-level security to protect your account. In addition, when you need to share your data with others, you can scramble it for additional privacy.

Alternatives to Rocket Money

Rocket Money can help improve your finances, but these other services can be better if you need hands-on help with a specific need. If none of these sound good, also check out our list of the best budgeting apps for couples.

You Need A Budget (YNAB)

If you want a serious budget and to stop living paycheck to paycheck, You Need A Budget (YNAB) is an excellent option. YNAB isn’t free, though; it costs $14.99 monthly or $109 annually, but there is a 34-day free trial to see if it’s a good fit.

The YNAB budget follows a zero-based budget approach, assigning each dollar to a specific task. So, you have to plan to spend or save every dollar you make, which is a well-tested and effective budgeting method.

The app walks you through the budgeting process and reviews many monthly expenses that are easily overlooked with basic budgeting tools like Rocket Money or Mint.

The spending and net worth reports are also robust. There are also several financial calculators to help you plan upcoming goals.

For more information, check out our full YNAB review.

Empower Personal Dashboard

Empower Personal Dashboard is arguably the best free net worth tracker available today, as you can link all of your banking and brokerage accounts and add manual accounts. The service includes basic spend tracking tools to categorize transactions and ensure you live within your means.

Creating savings goals and reviewing your investment portfolio’s asset allocation and fund fees is also possible. It has a suite of planning tools that are useful for retirement planning, but they will try to sell you on their wealth management services.

Read our Empower Personal Dashboard review for more information.

BillCutterz

BillCutterz can negotiate your existing bills on your behalf, and you only pay if it saves you money. BillCutterz can save you on bills such as, cell phone, cable, internet, satellite radio, and more. It takes about 48 hours after you submit the bill to find out if you’ve received any savings.

BillCutterz charges 50% of the annual savings it negotiates for you. For example, if they save you $20 a month on your cell phone bill, they will charge $10 per month for 12 months or $120. You can pay monthly or get a 10% discount by paying in full right away.

FAQs

What are the Rocket Money customer service options?

You can send a chat message within the app; the typical response time is within one day. Additionally, premium members receive priority support. An extensive online FAQ section also provides tutorials for the free and paid features.

Does Rocket Money cost money?

It’s possible to monitor your banking accounts, credit scores, and subscriptions for free. However, you must pay at least $4.99 monthly (or $35.99 annually) for unlimited budgeting rules, subscription cancellation, and other in-depth access.

Does Rocket Money sell your information?

Rocket Money won’t sell your personal information and protects your privacy. However, you may receive offers from other Rocket companies and third-party affiliates.

What happened to Truebill?

Until mid-2022, Rocket Money was known as Truebill. Rocket Companies, which also runs Rocket Loans, Rocket Mortgage, and LowerMyBills.com, acquired the money management app and renamed it Rocket Money. Shortly thereafter, the Truebill brand was sunset.

Is Rocket Money Worth It?

Rocket Money can be an effective way to make a free budget if you want to track spending easily and don’t need hands-on help. The paid subscription can be worth it if you need unlimited budgeting access and other money-saving tools. The “Pay What’s Fair” option makes it an even better value.

But while the app has several additional features, not everyone will find them all useful. If you’re looking for more in-depth tools for budgeting or tracking your spending, consider other options, such as YNAB or Personal Capital, in addition to Rocket Money.

Since it is free, it doesn’t hurt to try it out. You can also test drive the premium services to see if you find value in them.

Other Posts You May Enjoy:

Current Bank Review 2024: 4.00% APY on Savings plus $50 Cash Bonus

If you’re looking for a simple easy to use online bank, Current Bank may be for you. With a high interest rate and small cash bonus, it makes a compelling case for a place to park your savings.

GoHenry Review: A Feature-Rich Kids Debit Card for Smaller Families

GoHenry offers family-friendly debit cards for kids and teens that can help them learn how to manage their money and also participate in a digital economy that’s going cashless. This GoHenry Card review takes a closer look at how your child can use this card to learn how to manage money and pay the bills.

Best Chime Alternatives: Which One Is Best for You?

At 10 million members strong, Chime is a hugely popular online bank. But other fintech companies and digital banks offer similar products and features. How do you know which is best suited for you? Here are 10 online banks, like Chime, for you to consider.

Kikoff Review: Build Your Credit with $750

Kikoff offers a simple $750 line of credit with a $5 monthly payment that allows you to build credit effortlessly by establishing a regular payment history that reports to the major credit bureaus. This Kikoff review shows how this tool can help improve your credit score and if it’s worth using.

About Josh Patoka

After graduating in $50k with student loans in May 2008 from Virginia Military Institute with a B.A. International Studies and Political Science with a minor in Spanish (he studied abroad in Sevilla, Spain for 3 months), Josh decided to sell his soul for seven years by working in the transportation industry to get out of debt ASAP and focus on doing something else with a better work-life balance.

He is a father of three and has been writing about (almost) everything personal finance since 2015. You can also find him at his own blog Money Buffalo where he shares his personal experience of becoming debt-free (twice) and taking a 50%+ pay cut when he changed careers.

Today, Josh relishes the flexibility of being self-employed and debt-free and encourages others to pursue their dreams. Josh enjoys spending his free time reading books and spending time with his wife and three children.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.